refinance transfer taxes virginia

The average 15-year fixed refinance APR is 5250 according to Bankrates latest survey of the nations largest refinance lenders. The buyers half of the state transfer tax is waived if a first time buyer.

Car Financing Are Taxes And Fees Included Autotrader

The State of Virginia has three transfer taxes and two recordation taxes think of the recordation tax as a mortgage tax stamp.

/couple-breakfast-home-VACAYHOME0918-5dc9682c59aa4588bd20ff2a2cec5826.jpg)

. It includes protections for. A warranty deed promises that the person transferring the property has good title to it and the right to sell it. VA streamline refinance.

The buyer typically pays the state and county deed transfer tax. Check the IRS website for the latest information about income taxes and your state tax website for state-specific information. A financial advisor who specializes in tax planning can help lower your 1099 income taxes by harvesting your losses.

A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan. There are several ways to transfer real estate title. The seller pays a transfer tax to the state also known as the VA Grantor tax.

The amount of the funding fee is based on down payment and if its a purchase or refinance as well as whether its your first time or a subsequent use of your VA benefits. The Loan term is the period of time during which a loan must be repaid. It is typical to split all the transfer taxes 5050 between buyer and seller.

The 2nd court does not calculate any state taxes. For example a 30-year fixed-rate loan has a term of 30 years. A warranty real estate deed transfer is the most common type of deed used when properly is sold to a third party in a typical real estate transaction.

The 2nd court enters 20 and the system calculates the remaining 20 local tax amount due. -The state transfer tax is always the same. At Bankrate we strive to help you make smarter financial.

Figuring out your taxes can be overwhelming. SmartAssets income tax calculators will help you calculate federal state and local. True to its name this program also known as the Interest Rate Reduction Refinance Loan IRRRL pronounced earl involves little paperwork.

An Adjustable-rate mortgage ARM is a mortgage in which your interest rate and monthly payments may change periodically during the life of the loan based. Our refinance calculator will use the information you have provided to calculate your monthly payment. -The buyer is exempt from the state transfer tax if they are a first-time homebuyer in the state of Maryland.

Check the Timeshare checkbox if the underlying property is a timeshare. However Virginia divorce laws prevent any spouse from getting more than 50 of the accounts marital share. This means that you will be able to use your investment losses to reduce taxes on 1099 income.

This amount represents the total you will pay every month - including interest and principal. Virginia law defines the marital share as total interest earned between the date of the marriage and the date of separation. When you refinance you can also opt to have the bank pay your property taxes and homeowners insurance as part of escrow.

Transfer taxes are usually expressed as a set number of dollars per 100000 of the home. The extent of the division depends on several factors such as the type of plan. The state income tax rates range from 14 to 107 and the.

The state of New Jersey requires you to pay taxes if you are a resident or nonresident that receives income from a New Jersey source. Instruments which reference timeshares are exempt from the 100 transfer fee code 212.

Trump S Taxes Show Chronic Losses And Years Of Income Tax Avoidance The New York Times

Debt Arbitration What Is It How Does It Work

Utah Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

:max_bytes(150000):strip_icc()/RestrictiveCovenant-27d09738c385465493370c4b3ef22f99.jpeg)

Restrictive Covenant Definition

/couple-breakfast-home-VACAYHOME0918-5dc9682c59aa4588bd20ff2a2cec5826.jpg)

4 Reasons Not To Refinance Your Home

Need To Borrow A Lot Of Money Get A 100 000 Personal Loan Forbes Advisor

What Happens When You Pay Off Your Mortgage Forbes Advisor

Tax Prep Checklist Documents To Gather Before Filing Forbes Advisor

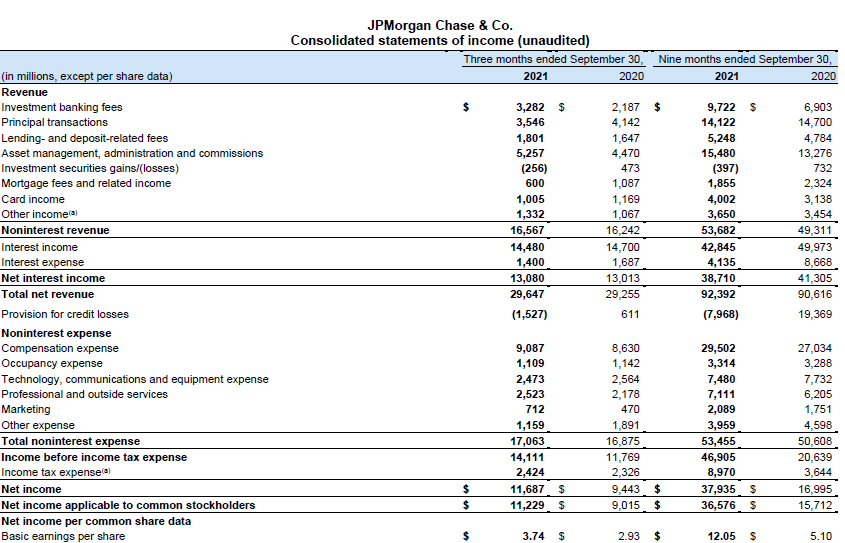

A Closer Look At Jpmorgan S 4 2 Yielding Preferred Shares Nyse Jpm Seeking Alpha

Capital Gains On Home Sales What Is Capital Gains Tax On Real Estate Guaranteed Rate

How To Get A Car Loan With Bad Credit Forbes Advisor

How To Get A Mortgage For A Rental Property Forbes Advisor

How To Lower Property Taxes 7 Tips Quicken Loans

What Is A Tax Sale Property And How Do Tax Sales Work

Tax Prep Checklist Documents To Gather Before Filing Forbes Advisor

/WetClosing-cc3f20cff6974378a89d49c28bab1332.jpeg)